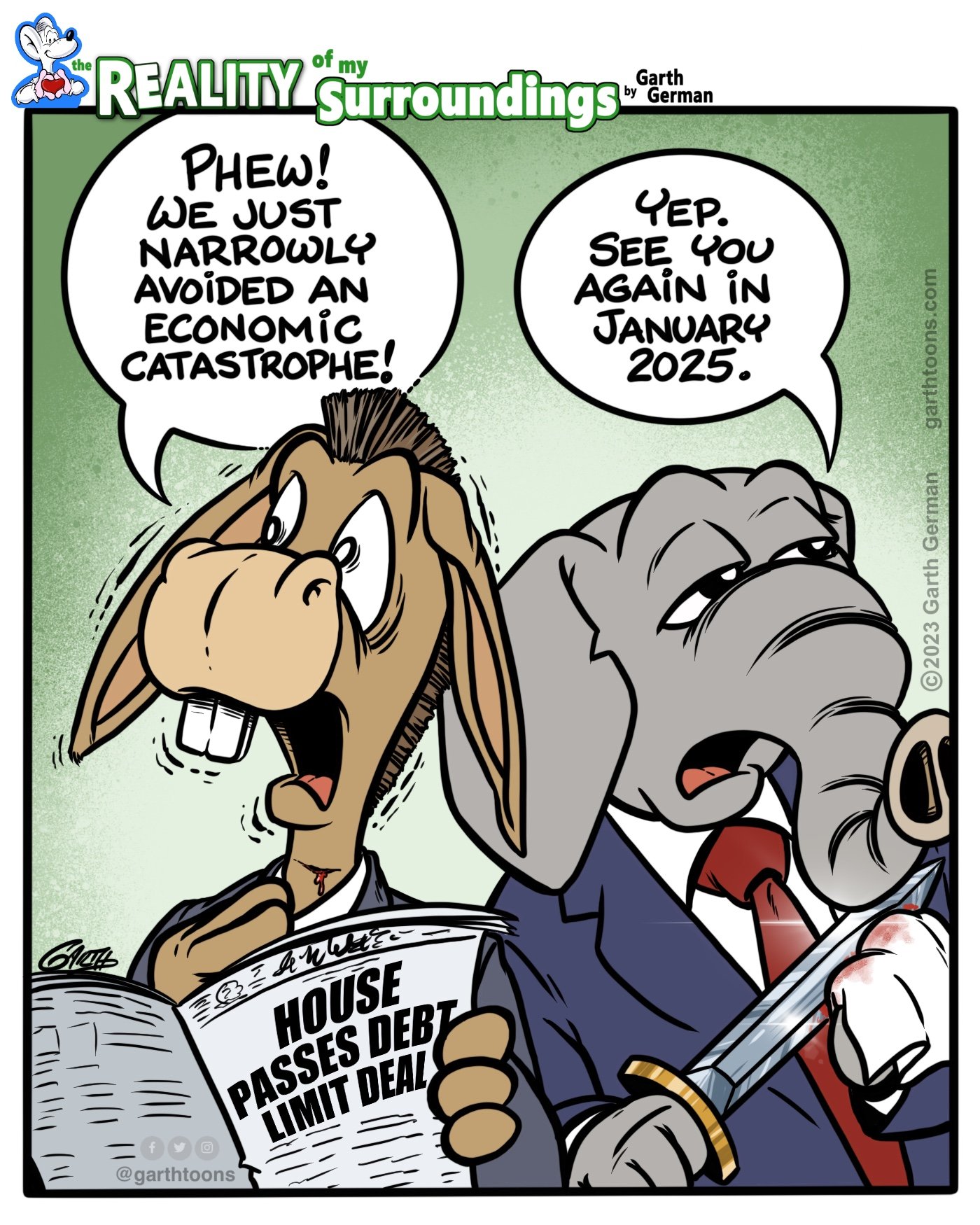

Countdown to Default

Tic tic tic. Bill’s coming due.

Offering No Solutions

The House GOP is again going to play chicken with the US debt ceiling, saying they won’t go along with increasing the debt ceiling without balancing the budget.

They’ve rejected outright any tax increase. They also want to take funds away from the IRS, which the CBO projects will increase the deficit.

Various GOP factions have outright rejected any cuts to defense spending. Many reject cuts to entitlements like Social Security and Medicare.

The target then becomes discretionary domestic spending, with very popular programs such as farm subsidies, water programs, infrastructure, and more.

But to balance the budget by cutting only discretionary domestic spending would require cutting 85% of that spending.

So far there’s no solution offered up, let alone one that will pass the Senate and White House.

So we’re left with what… magic thinking? Or the favorite response when they don’t know what to do, thoughts and prayers.

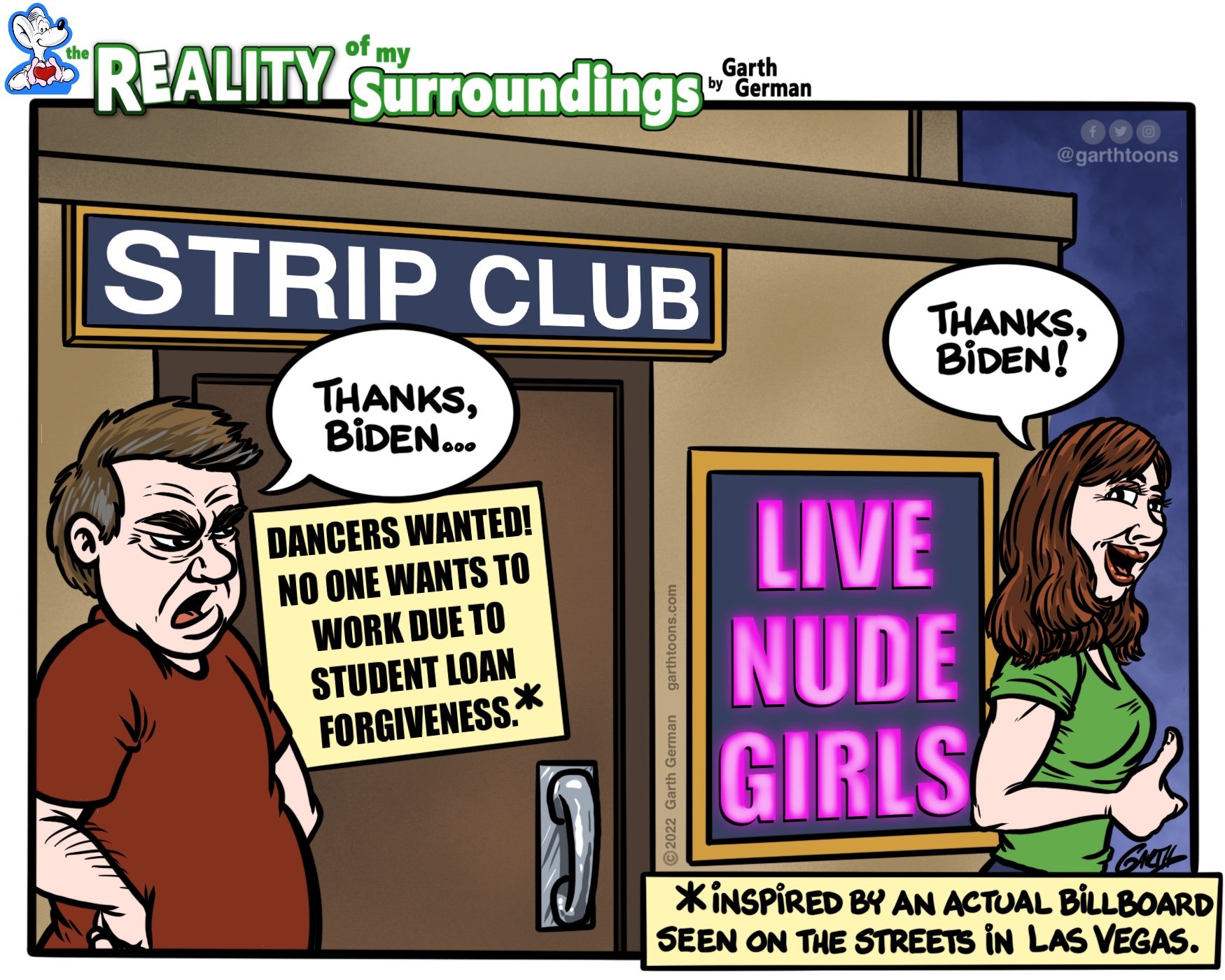

Thanks, Biden.

Yesterday, the Biden administration launched the application process for their student loan forgiveness program.

This cartoon is based on a billboard seen on the streets of Las Vegas. If women want to strip, more power to them. But if, as this billboards implies, they’re only doing it to pay off student loans and would decide to not do it if they don’t have the loans, then maybe the forgiveness is a good thing.

Student Loan Debt

President Biden announced his plan for student debt relief, canceling up to $10,000 in government backed student debt per individual (or up to $20k for Pell grant recipients).

While I don’t think this is any long term answer to our student debt problems, it’s going to help millions of people. Estimated to help up to 43 million borrowers, with 90% of the debt relief dollars going to people earning under $75k.

At the same time, Biden put a definitive end to the freeze on student debt payments.

Moody’s Analytics estimates the combined effects will largely be a wash on GDP growth, unemployment, and inflation.

I don’t think it’s the real solution we need to the soaring costs of higher education. We should address the underlying issues of the cost and not just one time fixes for some. It’s not like we should expect to do this every ten years or so. I understand people feeling it sets a bad precedent for others, so let’s address the bigger issue. But it’s hard to ignore the huge number of people who will have immediate, real, life altering benefits from this.

For those not getting debt canceled, it will likely result in no noticeable change. And projected to have no large negative effect on the macro economy.

Hard to argue against a move that won’t affect most people in any real material way, but will improve the lives of up to 43 million people.